First-time buyers often find real estate terminology overwhelming. Understanding the difference between a title and a deed is crucial when navigating property transactions. While these terms are often used interchangeably, they represent distinct concepts in real estate law.

What Is a Title?

A title is not a physical document but rather a concept describing ownership of something. This concept applies to property, vehicles, or intangible assets. When you hold a title, you have legal rights to use, enjoy, and transfer the property. While a title itself isn't physical, it's associated with legal documents like title abstracts and deeds that provide evidence of ownership.

Types of Real Estate Titles

There are several ways to hold title to real estate, each with different legal implications:

-

Sole Ownership:

The property is owned by a single individual or business entity. This is the simplest form of ownership, where one person has complete control and responsibility for the property.

-

Tenancy in Common:

Individual ownership shared by two or more persons, where each owner can transfer their title independently. Each owner has a distinct, undivided interest in the property, which can be equal or unequal shares.

-

Joint Tenancy:

Held jointly by two or more individuals with equal rights. This form of ownership includes the right of survivorship, meaning when one owner dies, their share automatically passes to the surviving owners.

-

Tenants by Entirety:

Held by legally married couples, considered one individual, with automatic transfer upon death. This form of ownership provides protection from creditors of one spouse and requires both spouses to agree to any transfer.

-

Community Property:

Held by married couples, where either spouse can transfer half. This form of ownership is recognized in certain states and treats property acquired during marriage as jointly owned, with each spouse having equal rights to manage and dispose of their half.

The Importance of a Title Search and a Title Abstract

Conducting a title search is essential to avoid financial losses and legal issues. This process verifies the seller's right to sell and uncovers any unknown liens, claims, or encumbrances that could affect your ownership. The results are presented in a "title abstract," which summarizes the property's history, including previous owners and any encumbrances.

ANSTitle conducts comprehensive title searches, prepares detailed abstracts, and issues title insurance, which is a requirement for mortgage-funded property sales. Title insurance protects both buyers and lenders from potential title defects that may not be discovered during the initial search.

What Is a Deed?

A deed is the legal document used to record the transfer of property rights and ownership. Unlike a title, a deed is a physical document that must be signed and notarized. The deed specifies the seller (grantor) and buyer (grantee), includes a legal description of the property, and is executed by both parties before being recorded in public records.

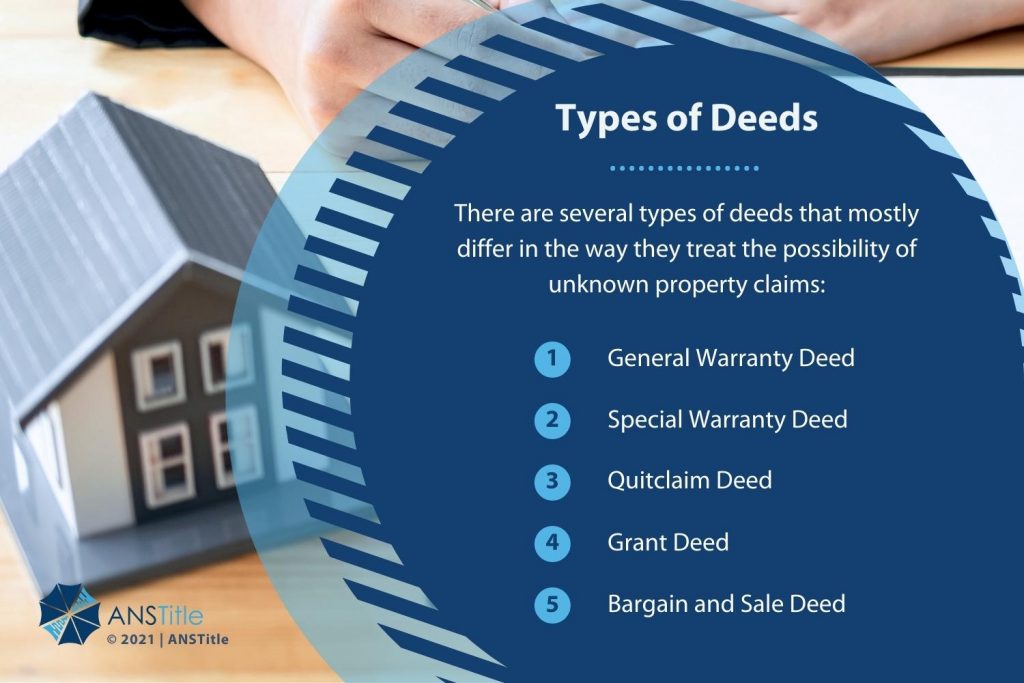

Types of Deeds

There are several types of deeds that mostly differ in the way they treat the possibility of unknown property claims:

-

General Warranty Deed:

The most common type of deed, it assures the buyer that the seller is the sole owner with full rights and no knowledge of property issues. This provides the highest level of protection for the buyer, covering the entire history of the property.

-

Special Warranty Deed:

Assures the property title is clear only under the current seller's ownership, common in commercial transactions. This provides protection only for defects that occurred during the seller's period of ownership.

-

Quitclaim Deed:

Transfers property rights without an actual sale, offering no guarantee to the current owner's rights. Typically used in interfamily transfers, name changes, or to clear up title issues. This provides the least protection for the buyer.

-

Grant Deed:

Assures the seller is the legal owner with full rights and no knowledge of property issues, but excludes guarantees for third-party claims after the sale. This is commonly used in California and provides moderate protection.

-

Bargain and Sale Deed:

Used with tax sales and foreclosures, provides no guarantees, meaning the buyer inherits potential liens. This type of deed offers minimal protection and is typically used in distressed property sales.

Summary

The key difference between a title and a deed is simple: Title is a concept describing ownership of something, while a Deed is the actual document used to transfer said ownership. Understanding this distinction is crucial when buying or selling property, as it helps you navigate the legal aspects of real estate transactions with confidence.

If you need further guidance on titles, deeds, or any aspect of the real estate transaction process, our experienced ANSTitle agents are here to help. With over 50 years of combined experience, we can provide the expertise and support you need to ensure a smooth and secure property transaction.