Title insurance is a specific type of indemnity insurance, which is typically acquired in conjunction with a real estate purchase. If you are a first-time homebuyer, you most likely have a number of questions about it. In this article, the ANSTitle agents will cover the basics of title insurance as well as answer the common question of why you need to purchase a policy for your new property.

Title Insurance Policy Types

Title insurance agencies offer lender’s and owner’s policies. The main differences between the two are the duration of the policy and who is protected by it. A lender’s insurance, which is meant to cover the mortgagee, remains active for the term of the loan. The owner’s policy, on the other hand, is enforceable for as long as the policyholder owns the property. Either policy, however, gets terminated if the real estate is sold. Â

Title Endorsements

Some properties have specific characteristics that may require additional insurance coverage. In those instances, the home buyer may need to purchase one or more title endorsements in addition to the basic title insurance. Each title endorsement is meant to cover a particular property scenario. You should consult with a title agent or a lawyer in order to determine what coverage may be needed.Â

For example, if the property you are looking at is only accessible through a neighboring parcel, you may want to add an Access and Entry endorsement to your policy. It will protect you from financial losses you may incur if your neighbor decides to no longer let you pass through their land to access yours.

Title Search

Another important aspect of obtaining title insurance is the title search process. Before the agency issues a policy, they will conduct a thorough title search. This process entails an extensive review of various property and tax records, in order to ensure that there are no known issues with the title of the property or, in order words, the title is clean. Â

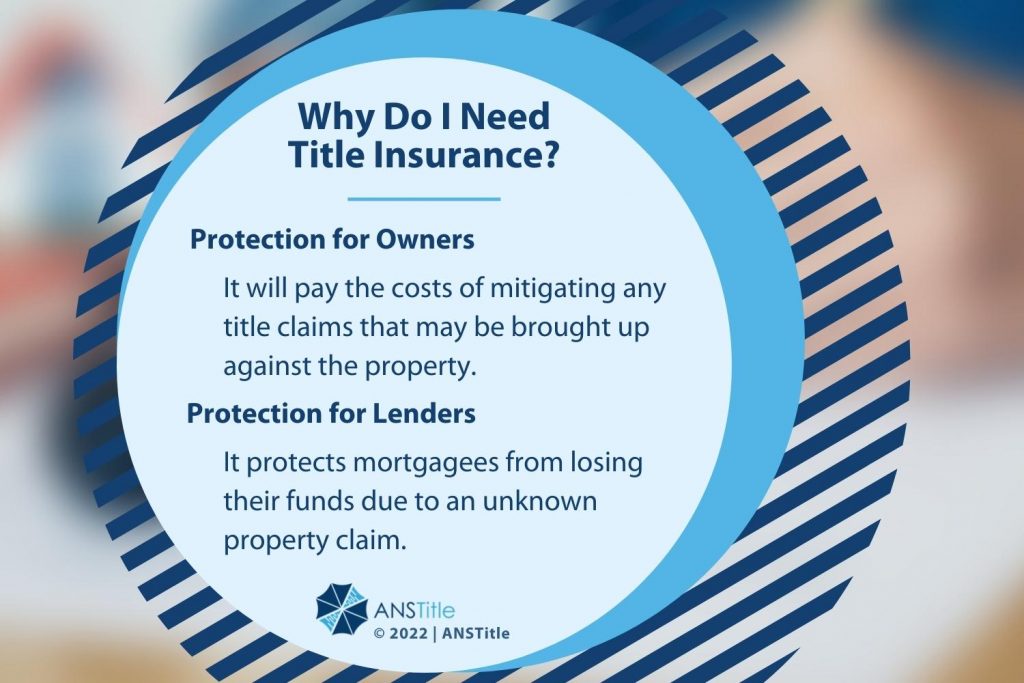

Why Do I Need Title Insurance?

Most homeowners are fortunate enough to never find out the true value of having title insurance. For others, however, having a title insurance policy may mean the difference between keeping and losing their property.

Protection for Owners   Â

Purchasing a home is one of the largest investments most people will make in their lifetimes. Yet, even one unexpected claim on the property can cause a homeowner to lose their financial investment and residence in one step. Your title insurance will protect you for as long as you are the owner. It will pay the costs of mitigating any title claims that may be brought up against the property. Keep in mind, however, that title insurance only protects against issues that have occurred prior to the purchase.

Protection for Lenders

Mortgage lenders also have a pretty big stake in the properties they finance. It is not uncommon for a bank to provide 80% or more of the funds needed to purchase a home. Lender’s title insurance protects mortgagees from losing their funds due to an unknown property claim.

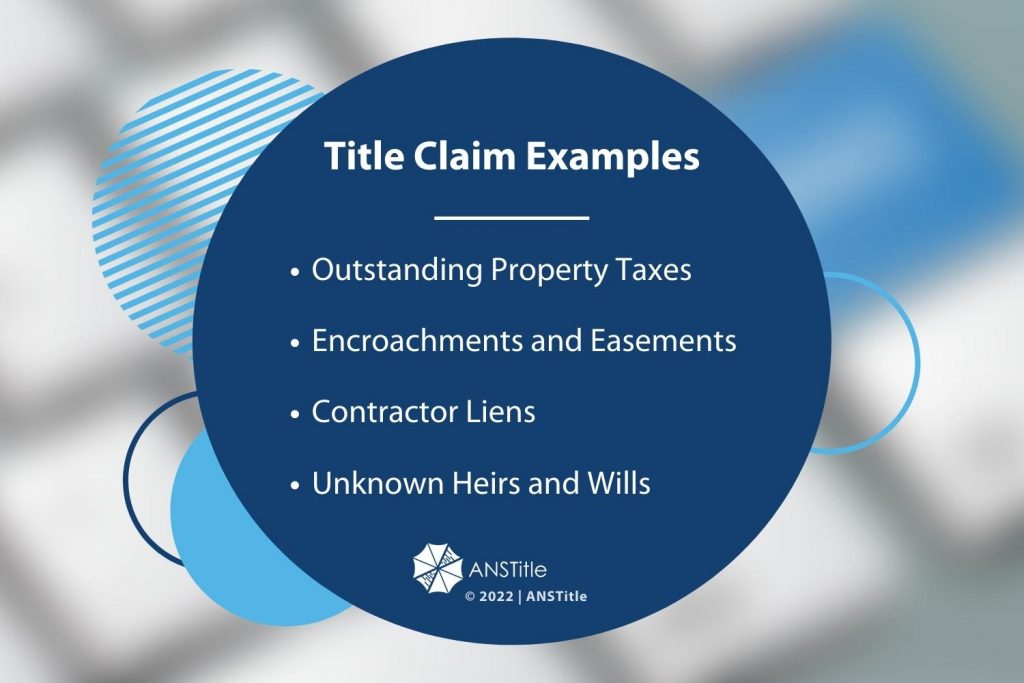

Title Claim Examples

There are a number of scenarios that may jeopardize an owner’s rights to their property. What’s even worse is that some issues may be discovered or brought up against the property decades after the original sale transaction. Let’s look at a few common title claims we have helped our title insurance clients resolve over the years.

Outstanding Property Taxes

If any of the previous owners skipped on paying property taxes, the local taxing authority may try and collect that past due money from you as the current owner. Depending on your location, the local tax collector may issue a tax lien on the property or, eventually, even auction your home in order to recoup the outstanding balance.

Encroachments and Easements

If any structure on your property is encroaching on a neighbor’s parcel or a utility easement, you may be responsible for removing the violating improvements. While relocating an incorrectly placed fence may not be a huge expense, imagine a scenario where the entire home needs to be demolished in order to comply with the law. Â

Contractors Liens

Another fairly common title claim scenario can arise from unpaid contractor bills. If a roofing company or another service provider completed work on the property in the past and was not reimbursed for their work, they can place a lien on the property.

Unknown Heirs and Wills

Imagine purchasing a property and then a few years down the road finding out that there is another rightful heir, who now claims that a piece of the property belongs to them. Even though you already paid the full price of the home to another party, a rightful owner can still place a claim on it.

Title claims may also stem from property survey errors, boundary disputes with neighbors, building code violations, and even forged recording documents.

How Do I Get Title Insurance?

Title insurance is purchased through a title insurance agency licensed to offer policies in the state where your property is located. The premium is included as a one-time fee in the closing costs of your transaction. While your mortgage lender or real estate broker would most likely recommend a title insurance agent, you are free to shop around and use an agent of your choice.

Title Insurance Prices

Unfortunately, shopping around won’t help you save money everywhere. If your property is in Texas, Florida, or New Mexico, you will pay the same premium regardless of what agent you choose. That’s because the state insurance departments in these states regulate the pricing of title insurance.

Agents in other states, however, are free to set their own prices. Remember, while saving money is always good, it’s not worth doing so at the expense of professionalism and good customer service. If you ever need to rely on your title insurance to resolve a claim against your property, you would want to deal with an expert. Â

Paying for Title Insurance

If you are taking out a mortgage to purchase the property, you as the buyer will most likely be required to purchase the lender’s title insurance. Banks will not approve your loan without a policy in place.

While purchasing an owner’s policy is optional, it is a good idea to obtain one. The owner’s title insurance can be paid by either the buyer or the seller of the property. Oftentimes, sellers agree to take on the cost of the title insurance premium as an incentive to prospective buyers. If your seller is not willing to pay for it, however, you should still consider purchasing the policy to protect yourself. Furthermore, most agents offer bundle discounts so adding an owner’s policy to the lender’s policy you are already buying will increase your overall closing costs marginally.

If you have any further questions about title insurance or the exact policy you should secure for your property, feel free to reach out to our agents. We have helped thousands of home buyers protect their real estate investment from unexpected claims. ANSTitle is directly licensed in 33 states; however, we can handle closings anywhere in the United States.